jersey city property tax calculator

Office of the City Assessor. New York Property Tax Calculator.

Jersey City Budgets The Connection To Property Tax Expense An Interactive Teaching Visual Civic Parent

Online Inquiry Payment.

. New Jersey has one of the highest average property tax rates in the country with only. For comparison the median home value in New Jersey is. HOW TO PAY PROPERTY TAXES.

For comparison the median home value in Jersey County is. Jersey City establishes tax levies all within the states statutory rules. TO VIEW PROPERTY TAX ASSESSMENTS.

Tax amount varies by county. The total amount of property tax to be collected by a town is determined by its county municipal and school budget costs. Your yearly tax is calculated based on your total taxable income in the year less any deductions you can claim.

Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON. Overview of New York Taxes. Total Tax Savings Years 18-20.

Follow these simple steps to calculate your salary after tax in Jersey using the Jersey Salary Calculator 2022 which is updated with the 202223 tax tables. Your average tax rate is 1198 and your marginal tax. In New York City property tax rates are actually fairly low.

DEC 20 2020. To view Jersey City Tax Rates and Ratios read more here. The current total local sales tax rate in Jersey City NJ is 6625.

Overview of Property Taxes. There is also an exemption threshold where you dont. Left to the county however are appraising property issuing levies making collections enforcing compliance and resolving.

The calculator makes standard assumptions to estimate your tax and long-term care. A towns general tax rate is calculated by dividing. In Person - The Tax Collectors office is open 830 am.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. For comparison the median home value in Ocean County is.

If you make 70000 a year living in the region of New Jersey USA you will be taxed 12783. City of Jersey City. New Jersey Income Tax Calculator 2021.

The money collected is generally used to support. The tax rate for The Oakman is calculated based on current variable factors that may. Enter Your Salary and the Jersey.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. By Mail - Check or money. To use the calculator just enter your propertys current market value such as a current appraisal or a recent.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. 189 of home value. Property taxes in America are collected by local governments and are usually based on the value of a property.

Calculation of income tax.

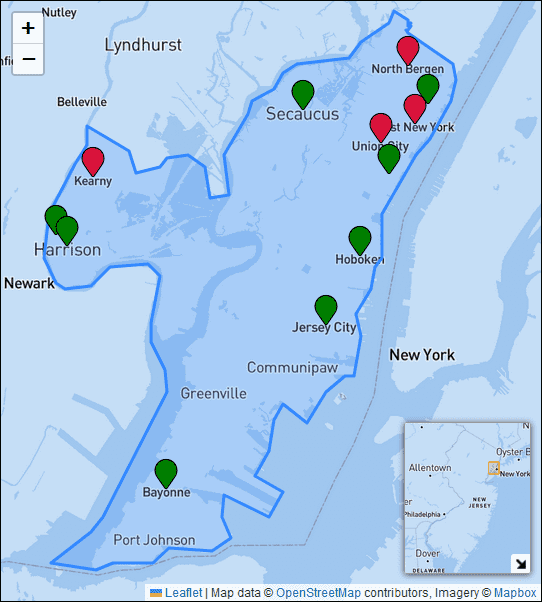

Property Tax Rates Average Tax Bills And Average Home Valuations In Hudson County New Jersey

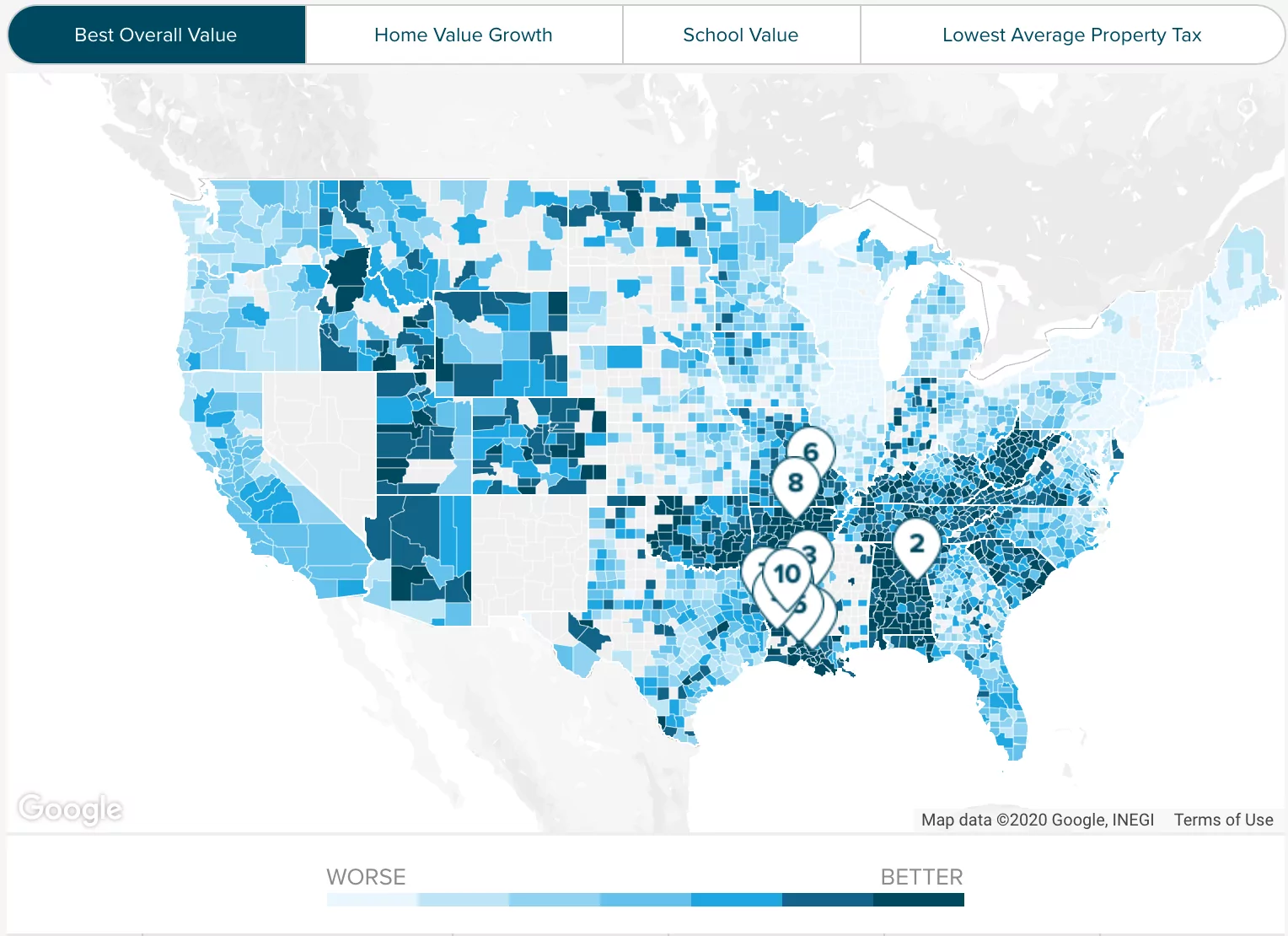

How Do State And Local Property Taxes Work Tax Policy Center

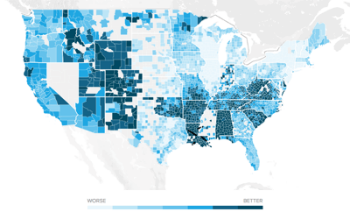

How High Are Property Taxes In Your State Tax Foundation

New Jersey 2021 Property Tax Rates And Average Tax Bills For All Counties And Towns

Calculator Shows Possible Tax Increase Of Illinois Labor Amendment Illinois Thecentersquare Com

U S Cities With The Highest Property Taxes

Property Tax Calculator Smartasset

Property Tax What It Is How To Calculate Rocket Mortgage

Washington Dc District Of Columbia Sales Tax Rates Rates Calculator

How To Stay Sane When Buying A Home In Nj Better Mortgage

How To Calculate Real Estate Taxes On Your Property

Property Tax How To Calculate Local Considerations

Where Do Homeowners Pay The Most In Property Taxes The Washington Post

Average Nj Property Tax Bill Rose Again In 2020 Nj Spotlight News

Property Tax Rates Average Tax Bills And Average Home Valuations In Hudson County New Jersey

The Jersey City Real Estate Market Stats Trends For 2022

Santa Clara County Ca Property Tax Calculator Smartasset

Property Tax Rates Average Tax Bills And Average Home Valuations In Hudson County New Jersey